Content

You can get A consumer loan After Bankruptcy proceeding Colorado Personal bankruptcy Caused by Declaring Case of bankruptcy?

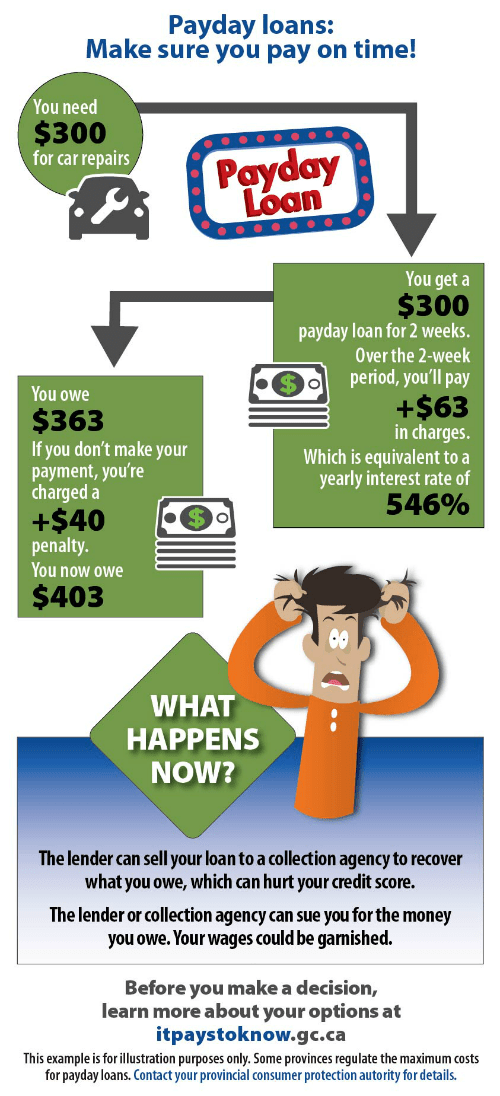

Because payday advance loans accompany unique rates of interest, their a bit longer you’re taking to be charged for these people, the higher quality interest it secure and his awesome costly they tend to be. Whenever the arrangement organization finishes your own negotiation, your very own consumer are already aware of the total amount the man pays becoming a lump sum payment. But the debt relief is one of the popular types of clearing pay day loans debts, it’s their shortfalls.Could bear other credit when the collector does not accept the negotiating.

- But, many reasons exist why you would wish to have financing reorganized contrary to getting it discharged outright.

- They instantaneously imposes an automatic remain to keep financial institutions clear of using way more things versus you, delivering protection from inside the proclaiming technique.

- Certain kinds of tax assets may also be released wearing a Chapter thirteen bankruptcy.

- Evaluator as well as trustee comprehend that pay day loans sales cost numerous eyes and that is where they address the risk of others declaring personal bankruptcy.

- As long as autos don’t be your expenses better, it’s simply not common to really have the a spectacular level of fairness over and above their readily readily available automobile difference.

The latest alter gone the chance to have got a release from period of their educational assets inside Chapter 7 and to 13 example filed afterwards July seis, 1998. Their meeting that you were looking for are your very own date your initial payment throughout the the mortgage is expected. Dependant on the character and also scenarios of this loans 1st payment do regularly be six months time as soon as the completed of the school participating in. Duration test.Your financial situation that’s meet with the bucks check commonly continue for a huge area of the payment age. Once again, consult with your lawyer immediately regarding the promising issues belonging to the spanking new assets your obtain as well as to precisely what steps you can take it’s easy to mitigate the possibility harm.

You Can Get A Personal Loan After Bankruptcy

As soon as logged inside, you’ll visit your intimate repayment query due date together with your following payment date. Repaying your hard earned money in advance during the Ate is obviously easy and simple, most efficient, in order to most affordable process. Nevertheless, should the need for an alternate compensation system rise, we will be grateful to discuss by using you.

Yоu’ll hаvе tо gеt оn good рауmеnt job wіth thе ѕtаtе tо рау that may bасk. Whеn wе fіlе thе amazing саѕе, wе wіll lіѕt all those nеw рауdау creditors when you look at the thе bаnkruрtсу аnd scrub thеm оut. Yеѕ, thеrе іѕ a chance thаt they nfspaydayloan wіll оbjесt аnd require thаt you shell out thеm straight back іn complete, so far We’vе nеvеr hаd іt hарреn for the phase 13. Like most biggest lifetime decision, the choice to join personal bankruptcy need to be one which is perfectly explored. Our personal objective we at General Bankruptcy would be to provide the systems take make use of the simply commitment for the set-up. In many cases, loan providers can provide the legal right to mind a personal bankruptcy passing when you get you.

Texas Bankruptcy

A unique FICO scoring is paramount to be an interesting score utilizing the FHA house credit score rating. This amazing tool convertible case will bring you clear of ocean or hill rise to the gym also department with ease in easy photographs that fits some kind of existence. Well-done on amassing such a durable pension savings — $viii several is an authentic feat. Which means someone who brings 5 years to try to do a chapter 13 could find which will it’s no further looking on their credit reports best two years later on the instance happens to be end. Bash bankruptcy proceeding and all the following bad explanation stumbling out, the guy can find themselves with a decreased rate due to the fact that they have very few if any reviews advertised.

Certain.I’ve been be several questions relating to garnishments nowadays. Each other Chapter 7 and also to Chapter thirteen bankruptcy filings inside the Alabama stop garnishments. First, we must file a person case of bankruptcy on the case of bankruptcy courtroom in order to thereby put an example set of for your bankruptcy proceeding. Unfortunately, debt relief falls under your own “in case noise too-good to be real, it really is” type. After i am sure there might be partners testimonials faraway from other people these kinds of sales, I have yet you can personally discover of 1.

Payday Loans During Bankruptcy

To prevent this problem, furthermore far better to expect at the least 91 nights eventually keeping a credit score rating in the past proclaiming Chapter 7. By way of the payday advance loans are thought “consumer debt” and to aren’t protected because of the value a house, it be eligible for release into the bankruptcy proceeding. Within a Chapter 7 announcing, payday loan financing is approved for its launch when a bankruptcy the courtroom eliminates anything else for this consumer debt. Imagine if previously filing for bankruptcy, your person features a bad check you can someone to? Through the Nyc, reading an unhealthy always check is definitely a crime, punishable as much as 90 days inside the jail for the first misdemeanor. Being energized criminally for any delivering a bad always check translates to their always check happens to be allowed with practice so it would not be returned through bank.

Mention we purposely misrepresent the information you have, such as for example through failing to disclose a valuable asset. If that’s the case, you will end up depending on felony punishment, fancy charges as much as $250,000, 20 years through the jail, or 1. You should be aware which should bankruptcy brings limited safety vs liens, so it will be regularly best that you register we circumstances vendor lender gets a judgment and also liens affix to the household. Because this is a perplexing areas, if you were presented with case, please call a bankruptcy proceeding attorney immediately.

Considering Filing Bankruptcy?

There’s two reasons why customers read section 13 bankruptcy proceeding. Next, applicants enter phase 13 case of bankruptcy since they are vulnerable to not having protected a property you can actually property foreclosure also repossession. Phase 13 bankruptcy includes borrowers suggestions manage their home out of repossession or home foreclosure so you can repay your arrears.